Germany’s Labor Law: A Comprehensive Guide for Enterprises

Germany, a federal republic comprising 16 states (Länder), operates under a federal system where each state has its own constitution, government, and independent courts. The federal government and parliament handle critical legislation, particularly in economic policy. The federal parliament consists of the directly elected Bundestag and the Bundesrat, both composed of state government representatives. As a key economic hub in Europe, Germany’s efficient and unique economic system attracts global enterprises for investment. Following the implementation of China’s “Going Global” strategy and the UK’s Brexit on January 1, 2021, Chinese enterprises are intensifying investments in Germany, particularly in green and low-carbon sectors like photovoltaics and wind energy. While companies initially relied on expatriate staff, there is a growing trend of hiring German employees. However, Germany’s labor and employment laws are complex, making it essential for Chinese enterprises to understand these regulations. This article provides a detailed overview of Germany’s labor law framework.

01 Key Labor Laws and Regulations in Germany

Unlike a unified labor code, Germany’s labor regulations are dispersed across various laws, case law, collective bargaining agreements, works council agreements, and individual employment contracts. Labor relations are governed by federal legislation, judicial precedents, and negotiated agreements. German labor legislation can be broadly divided into two categories:

1. Individual Labor Legislation

The Civil Code (Bürgerliches Gesetzbuch – BGB) serves as the cornerstone for individual labor relations, forming the basis for all employment contracts. Specific areas of labor relations are regulated by specialized laws, including:

- Part-Time and Fixed-Term Employment Act (Teilzeit- und Befristungsgesetz – TzBfG)

- Federal Leave Act (Bundesurlaubsgesetz – BUrlG)

- Dismissal Protection Act (Kündigungsschutzgesetz – KSchG)

- Minimum Wage Act (Mindestlohngesetz – MiLoG)

- General Equal Treatment Act (Allgemeines Gleichbehandlungsgesetz – AGG)

- Working Hours Act (Arbeitszeitgesetz – ArbZG)

- Maternity Protection Act (Mutterschutzgesetz – MuSchG)

The General Equal Treatment Act (AGG) is Germany’s primary anti-discrimination law, prohibiting direct or indirect discrimination in employment based on race, ethnicity, gender, religion, belief, disability, age, or sexual orientation.

2. Collective Labor Legislation

Key laws governing collective labor relations include:

- Collective Bargaining Agreements Act (Tarifvertragsgesetz – TVG)

- Works Constitution Act (Betriebsverfassungsgesetz – BetrVG)

- Co-Determination Act (Mitbestimmungsgesetz – MitbestG)

- One-Third Participation Act (Drittelbeteiligungsgesetz – DrittelbG)

02 Compliance Considerations for Labor and Employment in Germany

1. Local Employee Numbers and Proportion

German labor law does not mandate a specific number or proportion of local employees for foreign subsidiaries. However, the “Gender Equality” law passed by the German parliament requires large companies to ensure at least 30% female representation in senior management. Enterprises must consider this requirement when forming management teams.

2. Work Visas for Foreigners

Foreign nationals must obtain a work permit from the German Labor Agency to work in Germany, except for:

- EU citizens

- Individuals with permanent or settlement residence permits

- Those permitted to work under international agreements or specific laws

Non-EU citizens planning to work in Germany for over 90 days must apply for a residence permit and a work visa. Visa requirements may be waived under international agreements or EU/German laws.

3. Salary Costs

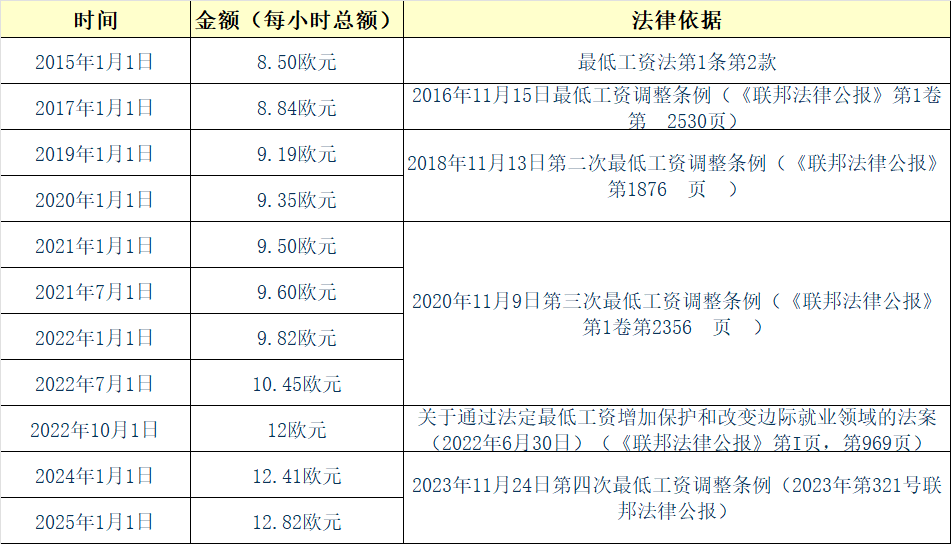

Salary costs in Germany include base wages and employer contributions to social insurance. The statutory minimum wage, effective from January 1, 2025, is €12.82 per hour. Violations of minimum wage laws can result in fines up to €500,000. Historical minimum wage adjustments are summarized as follows:

| Year | Minimum Wage (€/hour) |

|---|---|

| 2022 | 9.82 / 10.45 (Jul) |

| 2023 | 12.00 |

| 2024 | 12.41 |

| 2025 | 12.82 |

4. Social Insurance

Germany’s social insurance system includes health, pension, unemployment, long-term care, and accident insurance. Except for accident insurance (fully employer-funded), contributions are equally split between employers and employees. These costs are a significant component of employment expenses.

- Pension Insurance (Rentenversicherung – RV)

- Contribution rate: 18.6% (employer and employee each contribute 9.3%)

- From 2025, the national contribution ceiling is €8,050/month (up from €7,300 in 2024). For specific sectors like mining, the ceiling is €9,900/month (up from €9,300).

- Provides pensions based on contribution history and salary levels upon reaching retirement age.

- Health Insurance (Krankenversicherung – KV)

- Contribution rate: 14.6% + 2.5% supplementary fee (employer and employee each pay ~8.55%)

- Mandatory for all residents; ~90% opt for public health insurance (GKV), while high earners (>€73,800/year) may choose private health insurance (PKV).

- From 2025, the contribution ceiling is €66,150/year (€5,512.50/month), and the mandatory insurance threshold is €73,800/year (€6,150/month).

- Unemployment Insurance (Arbeitslosenversicherung – ALV)

- Contribution rate: 2.6% (employer and employee each contribute 1.3%)

- Provides financial aid, job training, and reemployment support for unemployed individuals.

- Long-Term Care Insurance (Pflegeversicherung)

- Contribution rate: 3.6% (employer and employee each contribute 1.8%)

- Covers long-term care costs for the elderly and disabled, including home care and nursing facilities.

- Accident Insurance (Unfallversicherung)

- Fully employer-funded; rates vary by industry risk (1%–5% of monthly salary).

- Covers workplace accidents, commuting injuries, and occupational diseases, including medical costs and 80% wage compensation.

03 Considerations for Labor and Employment Management

1. Employment Contracts

German employment contracts typically specify job type, location, working conditions, salary, working hours, paid leave, notice periods, and termination conditions. Employers must provide written proof of employment terms within one month of starting the employment relationship. For companies with works councils, proposed hires and roles must be discussed in advance.

- Contract Types:

- Fixed-Term Contracts: Limited to 18 months, extendable up to three times within two years. New businesses may sign fixed-term contracts for up to four years within the first four years of establishment. Without written confirmation, contracts default to indefinite terms.

- Indefinite Contracts: No fixed end date.

- Contract Signing:

- Per the Verification Act (Nachweisgesetz – NachwG), employment agreements must be signed in writing (electronic signatures are not accepted). Non-compliance may result in fines.

- Key Employment Terms:

- Employers must provide written terms within one month, including names and addresses, start date, contract duration (if fixed-term), working hours, salary structure, payment schedule, leave entitlements, notice periods, workplace, job duties, and applicable collective agreements.

- Probation Period:

- Maximum of six months, with a two-week notice period for termination during probation.

2. Personal Income Tax

Taxpayers are classified as residents (taxed on worldwide income) or non-residents (taxed on German-sourced income). The 2025 tax-free allowance is €12,084. Germany uses a progressive tax rate system:

| Income Range (€/year, 2024) | Tax Rate |

|---|---|

| 0 – 11,604 | 0% |

| 11,605 – 66,760 | 14%–42% |

| 66,761 – 277,825 | 42% |

| > 277,825 | 45% |

Tax classes (Steuerklassen) range from I to VI, based on marital status, income, and family circumstances.

3. Recruitment and Employment Management

- Job Interviews:

- Employers must comply with the General Equal Treatment Act (AGG), avoiding questions about pregnancy, family plans, political views, or religion. Only job-relevant questions are permitted. Candidates facing discrimination may claim compensation. Employers should document recruitment processes and train staff on equality policies.

- Background Checks:

- Limited to job-relevant information. Character or credit checks are generally prohibited unless directly relevant (e.g., for cashiers or security personnel).

- Non-Compete Clauses:

- During employment, employees are bound by statutory non-compete obligations. Post-employment non-compete clauses must:

- Serve legitimate business interests

- Be reasonable in duration (up to two years), scope, and geography

- Include compensation of at least 50% of the employee’s average income for the last three years

- Be in writing

- During employment, employees are bound by statutory non-compete obligations. Post-employment non-compete clauses must:

04 Termination of Employment Contracts

Employment contracts can be terminated via notification (most common) or immediate dismissal.

1. Notification Termination

- Statutory Notice Periods (per the Civil Code): Years of ServiceNotice Period< 2 years4 weeks2–4 years1 month5–7 years2 months8–10 years3 months11–14 years4 months15–19 years5 months≥ 20 years6 months

- Form: Termination must be in writing (electronic documents are not valid).

2. Immediate Termination

- Allowed only for severe reasons (e.g., gross misconduct, criminal acts against the employer) that make continuation of employment untenable.

3. Dismissal Protection

- Basic Dismissal Protection (per the Dismissal Protection Act):

- Applies to employees with over six months’ service in companies with more than ten employees.

- Dismissals must be “socially justified” based on:

- Behavioral Reasons: Serious breaches (e.g., refusal to work, faking illness) after warnings.

- Personal Reasons: Loss of ability to perform duties (e.g., no work permit, long-term illness). Illness-based dismissals require case-specific analysis.

- Operational Reasons: Business necessity with no alternative roles, following “social selection” criteria (age, tenure, family obligations).

- Employees not covered by this law can be dismissed without cause, provided notice periods are observed.

- Special Dismissal Protection:

- Applies to pregnant women, employees on parental leave, and severely disabled individuals. Dismissal requires approval from relevant authorities.

4. Severance Payments

Severance is not mandatory but may be required in cases like:

- Dismissals due to urgent operational needs

- Settlements in dismissal disputes

- Contractual agreements

- Collective redundancy social plans

Standard severance is 0.5 months’ salary per year of service, though amounts vary based on negotiations.

05 Practical Information Sources

- EU General Data Protection Regulation (GDPR): https://gdpr-info.eu/

- German Federal Data Protection Act: https://www.gesetze-im-internet.de/englisch_bdsg/index.html

- German Data Protection Authority (BfDI): https://bfdi.bund.de/EN/Home/home_node.html

- Business Environment Guide for Foreign Investment (China Council for the Promotion of International Trade)

- Country/Region Guide for Foreign Investment and Cooperation (Ministry of Commerce, China)

Note: This content is based on current German labor laws as of the provided reference. Please consult updated policies for any changes.